New Aggregated Second Dealing Point

Until now all online buy and sell trade instructions received before 1pm were combined at 2pm (“aggregated”) for trading. To provide same day dealing at that day’s prices, we will be adding a second dealing point.

This will improve the “time out of the market” for most clients as the majority of funds have a dealing point at 12:00 (midday). It will also mean that the majority of trades will be executed on the same day if submitted online before 09:30. (Managed funds usually trade once a day, although some trade less frequently. Most exchange traded instruments trade frequently throughout the day. Term deposits and structured products typically cannot be sold without charge until the end of their term.)

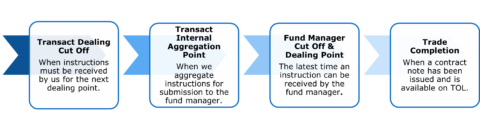

All online trade instructions received before 09.30 will be aggregated and we will submit these instructions to fund managers after 10.30. We aggregate deals to obtain the best overall results for our clients and minimise dealing costs. Our Transact Trading Cycle is detailed below.

Deals placed before Transact’s dealing cut off times receive the price at the next valuation point. Trades received after our cut-off will be priced at the subsequent valuation point.

We aggregate and submit client orders to execute orders before the fund manager’s cut-off. Managed funds trade once a day at the fund manager’s valuation point.

Transact dealing cut-off points for client orders

| Transact Dealing Cut-Off | Internal Aggregation Point | Execution | |

|---|---|---|---|

| Managed Funds | 9:30 | 10:30 | Between 11:59 and 15:00* |

| 13:00 | 14:00 | Between 15:00 and next business day before 11:59 |

|

| Exchange Traded Instruments | 9:30 & 13:00 | 10:30 & 14:00 | Twice daily |

*The majority of managed funds are dealt at 12:00; exceptions are detailed on Transact Online by downloading the ‘Investment Search Report’ available via Information > Investment Search.**Stock Exchange Opening times applicable.

Comparison between managed funds and exchange traded instruments

| Managed Funds | Exchange Traded Instruments |

|---|---|

| OEICS, unit trusts | Shares, ETFs, investment trusts, equities. |

| Managed funds usually trade once a day, in accordance with the fund manager’s valuation point although some trade less frequently. | Most exchange traded instruments trade frequently throughout the day. |

| Transact cut-off: 09:30 & 13:00 | Transact cut-off: 09:30 & 13:00 |

| Execution: Aggregated and submitted once | Execution: Aggregated and submitted twice |

1. Introduction

2. TOL Recent Enhancements

3. Development Summary for 2023

4. New Aggregated Second Dealing Point

5. Succession Planning Update

6. Share Class Conversion

7. Transact – BlackRock MPS Update

8. Maximum Tax-Free Cash Options

9. Fund Changes

10. Interest on Cash Deposits

11. Transact Events 2024