TRANSACT INHERITANCE TAX INDEX

Transact has worked with Trajectory, a team of strategic insight and foresight experts that help organisations understand how the world is changing. They helped us examine an ever more prominent issue: inheritance tax (IHT). As IHT becomes more of an issue due to the level of inherited wealth increasing, an analysis has taken place to assess the number of households that fall within the scope of IHT and the overall value of IHT liability in the UK based on thresholds determined by Transact. Transact wants to help financial advisers and their clients by creating an index that raises awareness.

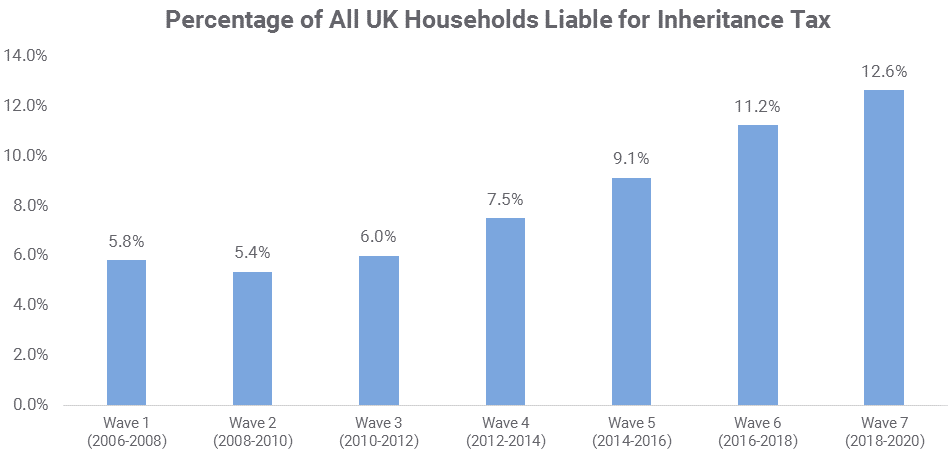

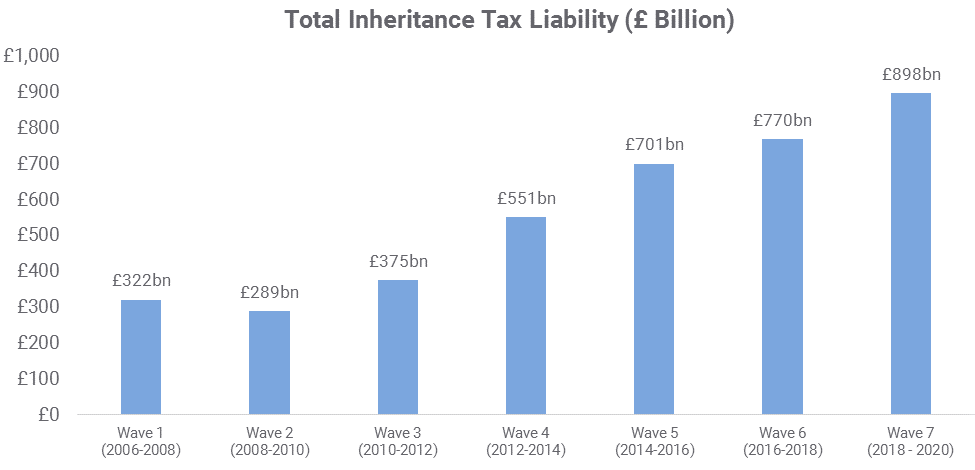

Based on the recent data from the Wealth and Assets Survey sourced from the Office of National Statistics, we have jointly conducted an analysis of the number of households that fall within the scope of IHT and/or the overall value of IHT liability in the UK, with some interesting findings:

- By the end of 2020 more than 3.5 million households were potentially liable for IHT.

- By 2020 the potential tax liability was at a high £898bn.

- The number of potentially liable households had also greatly increased by almost two million, from 1.49 million to 3.51 million between 2006 and 2020 .

- The percentage of liable households in London more than doubled during the same period.

We have created an index to raise awareness of IHT, allowing financial advisers who use our platform to more easily address the needs of their clients and track the ongoing potential liability of their clients.

The picture for UK households

The data illustrates a growing issue. The graphs below show that by the end of 2020 over 1 in 10 households were potentially liable for IHT. There has been a consistent increase in this number since 2008. It is also clear how the total IHT liability has almost tripled between 2006 and 2020, with the potential tax liability at an all-time high of £898bn by 2020.

You can find out more by reading the full white paper below.

If you have any questions you can contact us.

This document is for use by financial professionals only. It is intended as general guidance only and should not be used as a recommendation to use or rely on any of the features mentioned. The information contained in this document is not advice, nor is it a substitute for advice.