RESOURCES

Whether you’re a seller or a buyer, our ultimate aim is to help you find a good fit and execute a deal that benefits both parties and your clients.

As well as the below guides, we have also been working with Kingmakers to produce a number of workshops to guide you through the acquisition process both as buyers and sellers. These workshops include the below topics and are available on request.

Buyer Workshops

- Planning tools, understanding the market and your preparation

- Target and search

- Valuation, terms and appraisal

- Funding, legals, completion and post completion.

Seller Workshops

- Introduction and case study

- Valuing a firm

- 4 typical deal structures

- Maximising value and further assistance.

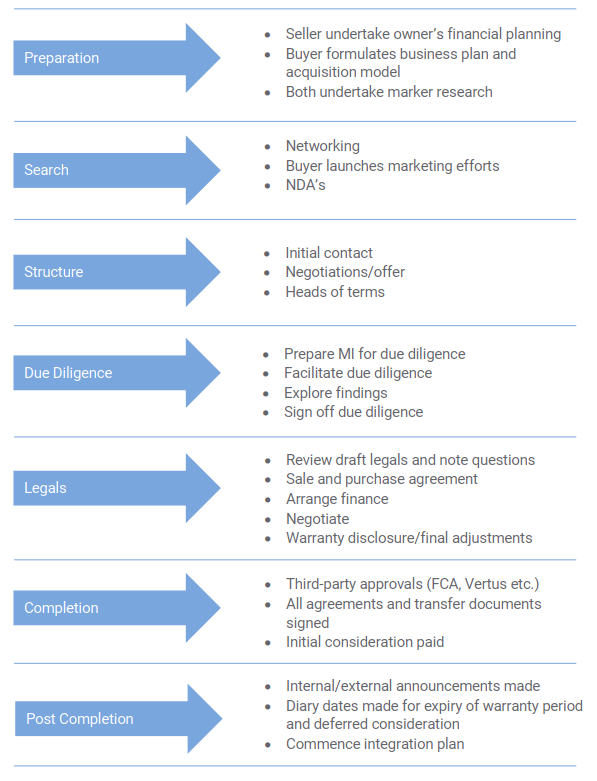

The Acquisition Process

Below is our useful diagram to give you an overview of the acquisition process.

Management Buyouts

If you have the team in place with the skills and ambition needed to take over and run your business, a management buyout may be the preferred option when considering your succession plans.

It should be more straightforward than a sale to a third party as you are dealing with people you know and already have a good working relationship. These people have helped build the business and establish the culture and know what they are taking on. This means that the legacy you have built should be well looked after by the next generation of advisers and there should be minimal disruption for your clients.

To carry out a management buyout requires preparation. The below presentation from Vertus and NextGen Planners outlines the process and steps needed to implement a successful transition.

Discussion Paper

This is a guide written by Rob Stevenson at Kingmakers. It focuses on a typical business owner as he navigates the process and ultimately finds the right buyer and completes the sale of his firm. Told as a story with key insights from us at the end of each chapter, it has been created to help you understand the key challenges and opportunities associated with this situation.

Going DA

This guide is written by Phil Young who has worked in pivotal roles at both Bankhall and Threesixty before setting up Zero Support. It explores the pros and cons of being directly authorised or a network member, and covers topics such as capital adequacy, support, professional indemnity and impact on proposition.

Additional Resources

Forms and Guides

Short reads that help you better understand your succession options, the importance of finding a good fit, key aspects of the transaction process and integration.

These documents are for use by financial professionals only. They are intended as general guidance only and should not be used as a recommendation to use or rely on any of the features mentioned. The information contained in these documents is not advice, nor is it a substitute for advice.