Structured Product Trends

You may be aware that we offer structured products on the platform. We currently have ten structured product providers live from which to choose and will soon be adding an eleventh provider – hop investing.

Structured products have been increasing in popularity. The number of structured products made available on the platform has increased by 25% from 2022 – 2023 and this is projected to increase by another 8% from 2023 – 2024. The current top providers by holdings are detailed below.

| Position Ranked by Holdings | Provider |

|---|---|

| 1 | Meteor Asset Management Ltd |

| 2 | Walker Crips Structured Investments |

| 3 | Mariana Capital Markets LLP |

| 4 | IDAD Limited |

| 5 | Tempo Structured Products |

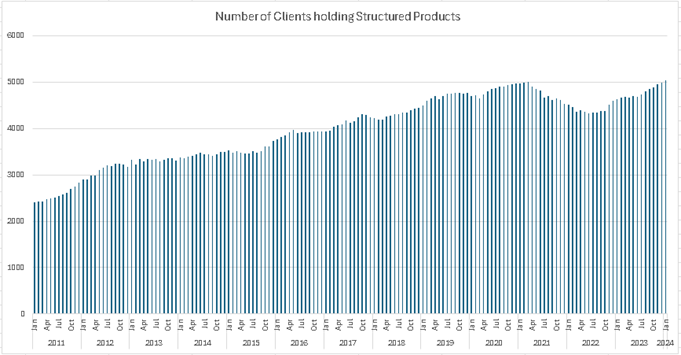

Structured products have been available on the platform since 2011. There has been a general increase in demand, with a peak at the start of 2021, and a subsequent bounce back to those levels.

Adding a new structured product to the platform doesn’t take very long. Typically it takes just three days from receipt of a request (by our product team) to a structured product being available. This process includes sourcing the KID and EMT directly from the provider and conducting a full review of both documents, as well as the structured product brochure. It is worth noting that given many structured products have very similar names and terms, we would expect a brochure to be provided with every request we receive for adding a new structured product to the platform to ensure we review the correct terms.

We work very closely with structured product providers to facilitate late or reserved business entering plans and have put in place processes to make this as efficient as possible.

Structured products obviously aren’t for everyone and we’re unable to comment on specific issues of suitability, but if you would like to discuss any aspect of our structured product process or trends in more detail, feel free to reach out to Stuart Fleat, National Sales and Sales Development Manager, on 07908 205905 or email sfleat@integrafin.co.uk.

1. Introduction

2. TOL Recent Enhancements

3. Structured Product Trends

4. Linking Third Party Offshore Bonds To A GIA

5. Transact Webinar Highlights From 6 February

6. Transact Data API

7. Transact – BlackRock MPS

8. Transitional Tax-Free Amount Certificates For The New Pension Allowances

9. Fund Changes

10. Interest on Cash

11. Transact Events 2024