ESTATE PLANNING WITH A SPOUSAL BYPASS TRUST (SBT)

With proposals to bring unused pensions into the deceased’s estate for inheritance tax (IHT) purposes from April 2027, a spousal bypass trust may once again become an attractive option for passing wealth down through the generations.

Since the introduction of pension ‘freedom and choice’, the use of spousal bypass trusts (SBTs) has declined. While an SBT offers greater control over who benefits and when distributions are made, the tax treatment compared with a beneficiary’s flexi-access drawdown (FAD) has generally favoured the use of FAD arrangements.

What is a Spousal Bypass Trust (SBT)?

A spousal bypass trust (SBT) is a discretionary trust normally set up during an individual’s lifetime (often with a nominal initial amount) to receive lump sum death benefits from a pension scheme following the settlor’s death.

The key features are:

- It allows pension death benefits to be paid into the trust rather than directly to a surviving spouse, so the funds do not form part of the spouse’s estate for IHT

- Benefits can still be provided to the spouse, commonly through repayable loans. On the spouse’s death, any outstanding loan is deducted from their estate, reducing its IHT liability.

- The funds held in trust are disregarded in local authority financial assessments for care provision.

- The trust can continue after the spouse’s death to provide benefits for children or other beneficiaries, in line with the settlor’s wishes.

- The trust is subject to the relevant property regime, which means periodic (10-yearly) and exit charges apply.

- Income and capital gains within the trust are taxed at trust rates (income tax at 45%, dividend income at 39.35%, and capital gains at 24%). Distributions of income to beneficiaries carry a 45% tax credit, which beneficiaries can offset against their own tax liabilities.

What tax is payable when pension death benefits are paid into the trust?

The tax treatment of lump sum death benefits paid to a spousal bypass trust depends on the member’s age at death and the timing of the payment. The table below sets out the position before and after April 2027, when unused pension benefits are proposed to fall within the deceased’s estate for inheritance tax (IHT) purposes. This assumes the pension scheme administrator makes payment within two years of notification of death.

| Death before age 75 | Death after age 75 | |

|---|---|---|

| Before April 2027 | Lump sum paid into trust is usually tax free up to the available lump sum and death benefit allowance (LSDBA) with income tax due on the excess | Lump sum paid into trust subject to 45% special lump sum death benefit charge |

| From April 2027 | Lump sum paid into trust is subject to IHT at up to at 40%. Income tax also due on lump sum in excess of LSDBA . | Lump sum is subject to both IHT up to 40% and 45% special lump sum death benefit charge |

Current tax position

Under current rules, paying pension death benefits into a spousal bypass trust is often tax-inefficient if the member dies after age 75. The 45% special lump sum death benefit charge applies, significantly reducing the amount reaching the trust. Coupled with the tax regime for trust investments—where income and gains are taxed at higher rates—a beneficiary’s flexi-access drawdown (FAD), which allows for tax-free investment growth, is usually more attractive.

If the scheme member dies before age 75, lump sum death benefits paid into a trust are generally tax free provided the payment is made within two years of death and does not exceed the available LSDBA. Any lump sum above this allowance will be taxed as income of the trust at 45%. Although investment income and gains arising in the trust are subsequently taxed at the rates applicable to trusts, the trust’s flexibility to make loans (instead of capital distributions) can assist in mitigating inheritance tax (IHT) exposure in the beneficiary’s estate, as these loans are repayable on death and reduce the value of the beneficiary’s estate for IHT purposes.

Tax position from 6 April 2027

With unused pension funds brought within the scope of inheritance tax (IHT) from April 2027, using flexi-access drawdown (FAD) across multiple generations could expose the fund to IHT at each generational transfer—spouse/civil partner successions are exempt, but a charge will normally arise on their subsequent death. Even where a spousal exemption applies on the first transfer, IHT will broadly apply on the later death of that surviving spouse.

By contrast, if pension lump sum death benefits are paid into an SBT, an IHT charge typically arises only once—on the death of the original member—since the trust owns the proceeds thereafter. Further distributions to beneficiaries (including spouse or children) do not trigger additional IHT on their deaths (although periodic and exit charges apply).

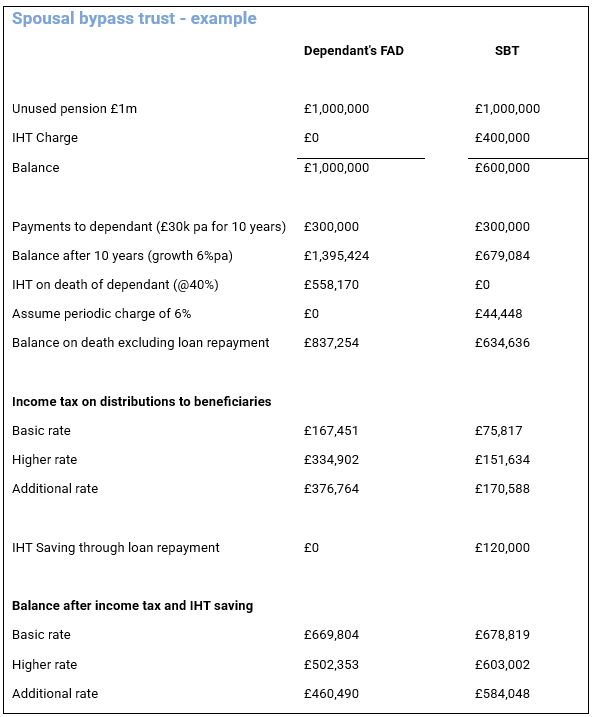

A comparison of the tax impacts for a surviving spouse using FAD versus an SBT are shown below. The example assumes the original pension member dies under age 75 with a pension fund of £1m. They are survived by their spouse, who dies 10 years later aged over 75. IHT at 40% has been deducted from the payment into the trust (although it is likely that there would be some nil rate band available). Growth of 6% per annum on the underlying assets has been used for both scenarios, with the bypass trust investing in an offshore bond.

Under each scenario, the surviving spouse receives £30,000 per year—either tax‑free income from the FAD or loans from the SBT. The spouse dies after 10 years, having received a total of £300,000. On death, an IHT charge arises on the unused pension funds (this example assumes no nil‑rate band is available). An assumed periodic charge is also included for the SBT, although in practice the timing of the first charge depends on when the settlor originally joined the pension scheme.

For the FAD, income tax has been deducted on the full amount of distributions paid to beneficiaries. By contrast, where the SBT holds an investment bond, income tax is due only on the chargeable gain. A final adjustment has been made to reflect the IHT saving that results from the loan repayment back into the estate.

This example shows that, in the right circumstances, the SBT can provide tax advantages. Both routes result in IHT charges: at outset for the SBT (as well as periodic and exit charges), while the unused funds in the FAD create an IHT charge on the dependant’s death. In addition, because death occurs after age 75, income tax is payable on the entire FAD distribution to beneficiaries. In contrast, tax on SBT distributions arises only on the chargeable gain.

All information is based on our understanding and interpretation of applicable law and regulation which is subject to change.

1. Introduction

2. Transact Online (TOL) – Recent enhancements

3. LiveChat now supports client & transaction-specific queries

4. Transact covers UPS delivery charges for cheques

5. Transact supports improvements to industry in specie transfer times

6. Succession planning – keep clients involved

7. The Transact–BlackRock MPS turns three

8. Estate planning with a spousal bypass trust (SBT)

9. Covering the IHT liability in a pension

10. Capital Gains Tax – impact of recent changes and possible reforms

11. Interest on cash

12. Transact events 2025