Adding Value To Family Businesses

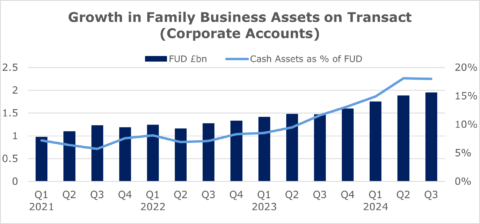

At Transact, we have always had market-leading cash propositions available for investors, but we thought it would be useful to highlight some recent trends that we have seen in relation to family businesses (corporate entities) holding cash within Transact portfolios. Since the start of 2021, corporate client assets overall have grown FUD from £0.9bn to £1.9bn, whilst cash assets within that have increased fivefold and, as a percentage of FUD, from 7.2% to 18% as shown in the graph below.

We have seen over the course of recent months, significantly increased volumes of corporate cash being introduced to Transact by our adviser firm users as they have identified more opportunities to engage with business owners and, subsequently, the assets of the extended families. In fact, volumes of corporate cash inflows are between 50-100% up on corresponding months from the previous year. After some internal analysis, we have seen that:

- Nearly two-thirds of corporate portfolios are linked to personal family monies.

- 42% more adviser firms have introduced corporate cash cases to us versus the same quarter a year ago (Q3 September 2024 vs 2023).

Many adviser firms have already identified the benefits of moving cash onto the platform for individual clients, that elsewhere, may be getting lower rates of return e.g. from High Street banks. Beyond the benefits that clients get of good rates of interest on Transact, there is also the potential for reduced charges on their other investments (when the total of the linked portfolio values moves above the next charging threshold). These benefits also apply for corporate cash. Often, within SMEs, there is an element of ‘lazy cash’ that could be held on a platform, and then linked to personal assets for family discounts. The higher rate of interest on corporate cash holdings also has the potential to offset other costs within the business such as the recently increased employers NI, and even accountancy costs for the SME.

For example, a typical 30 employee business with an annual wage bill of around £1.0m could see this increase by ~£26k as a result of the recent NI changes announced in the budget. Investing spare cash that business might have of £600k earning very little in a high street bank onto the Transact Platform could yield sufficient return to entirely offset the NI increase. The current payable rate on Transact for cash interest is 4.66% (at October 2024).

With cash currently held across seven banks, corporate clients can save a great deal of time and effort by investing via the platform rather than coping with the challenges of trying to manage multiple cash positions themselves. We understand that it is very hard for small businesses to open a bank account, and time consuming to open multiple accounts to improve the interest rate they receive.

We would be more than happy to discuss with you how we can help deepen relationships and create new opportunities, so please do talk to our Business Development Managers and Adviser Support Managers – they would be delighted to help.

1. Introduction

2. TOL Recent Enhancements

3. Removal of Adviser Purchase Related Fees

4. Platform Health Check

5. Adding Value to family Businesses

6. LoA Discounted Service

7. Transact – BlackRock MPS Two Years On!

8. Pensions Death Benefits and a Time For Reflection

9. Pensions, IHT Headaches And The Potential For Gifting

10. Finance Act 2024 and Abolition of LTA

11. Interest on cash

12. Transact Events 2025