Transact & US Trading

Comparing platform charges can be complex. It is important to look at all the fees that may apply to your client. For example, we have an annual platform fee and some wrappers fees plus an additional charge can be incurred for brokerage i.e. for buying or selling stocks traded on a stock exchange. Where a stock can settle in CREST, a Transact client will pay up to £3.75 in brokerage which is typically reduced due to our aggregated dealing model. This fee of £3.75 is then split across the portfolios trading that stock.

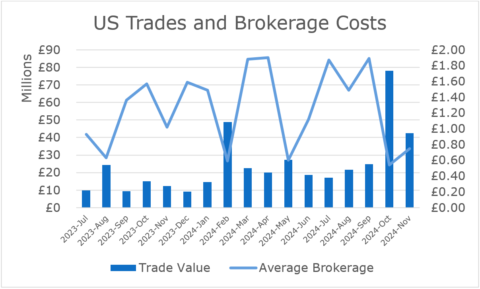

Transact can trade most North American stocks (e.g. Tesla Inc). We have seen a general increase in US trade volumes in the last year, peaking at almost £80 million in October (as shown below) ahead of the US presidential election. The graph below also shows that the corresponding average brokerage charges over the same period varied from ~50p to just over £1.80 at times. It demonstrates that, although always competitively priced for brokerage charges, with volume comes economies, and a reduction in brokerage charges when trading volumes are higher.

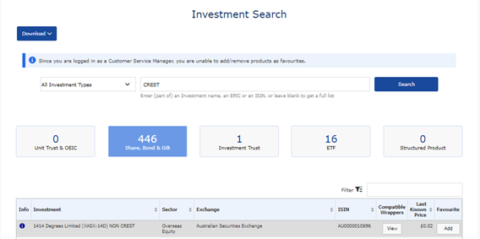

Where a stock can settle in CREST, these deals are routed to Winterflood Business Services (WBS) who act as our broker and have access to the whole of market. NON CREST stocks have NON CREST in Investment name as shown in the TOL screen shot below.

If you have any questions about product availability or brokerage fees, our Product team can be contacted on: products@integrafin.co.uk.

1. Introduction

2. TOL Recent Enhancements

3. Transact 2025 Charge Reduction

4. Why Some Firms Integrate Directly With Transact

5. Transact & US Trading

6. Succession Planning Update

7. Transact – BlackRock MPS & Growth

8. A Study Of Gifting: Loan Trusts

9. The Name’s Bond: Are Investment Bonds The 007 Of Financial Planning?

10. ISAs – Treatment Of Accounts Following Death

11. Interest On Cash

12. Transact Events 2025