Transact – BlackRock MPS update

Capital at risk. The value of investments and the income from them can fall as well as rise and is not guaranteed. Investors may not get back the amount originally invested.

Latest performance update

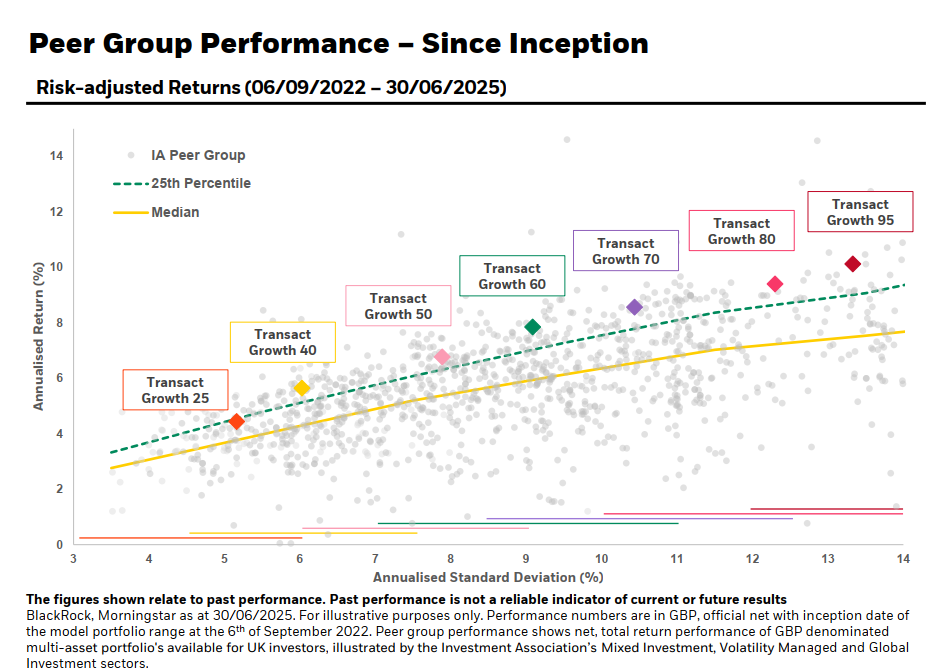

We’re pleased to confirm that majority of models have delivered top quartile performance since inception – critically, this has been achieved while consistently maintaining risk within their defined target ranges. See the latest performance for the service against its peer group below.

Transact – BlackRock MPS: Under the bonnet

When it comes to investing, we believe consistent performance is the result of a disciplined, research-led process – not the starting point. Long-term success comes from backing a robust investment philosophy and sticking to it, rather than chasing short-term outcomes. Since inception, the Transact – BlackRock MPS has delivered top quartile risk-adjusted performance relative to its peer group – a reflection of the strength and consistency of our approach.

Over the next few Adviser Updates, we’ll explore some of the key elements of the investment process and the principles that shape BlackRock’s decision-making – from maintaining discipline while staying dynamic, to rethinking diversification and managing costs. Each piece will aim to bring greater transparency to the decisions behind the MPS, and to the processes that drive long-term results.

We begin this month with a look at a critical yet often overlooked aspect of multi-asset investing – the impact and management of currency. We’ll explain how BlackRock think about currency exposure, the role it plays in the portfolio construction, and how BlackRock’s approach helps balance risk and opportunity over time.

Why FX shouldn’t be an afterthought

When investing globally, currency exposure can have a real impact on returns for UK investors. Exchange rate movements can, of course, work in your favour – for example historically periods of market stress have often seen the US dollar strengthening, with USD exposure helping to cushion portfolios – but it can also increase volatility and drag on returns when sterling is strong. If you need a real-life example, look at returns for the S&P500 year to date for a both a UK (GBP) and US (USD) investor. They will have had very different experiences, as at the end of June the difference was around 7-8%. That’s why, within the MPS, BlackRock treat currency as a key design decision, not just a by-product of investing overseas.

Importantly, both the diversification benefits and the cost of hedging vary over time. Shifts in interest rates and market sentiment affect how valuable – or expensive – it is to hedge. That’s why managing FX exposure isn’t about taking a view, it’s about staying aligned to portfolio objectives.

BlackRock’s approach

BlackRock recognise currency as being one of the key drivers of portfolio risk and take a balanced and intentional approach to currency exposures within the Transact – BlackRock MPS:

Fixed income is generally fully hedged to GBP – reducing unwanted volatility in what is supposed to be the most stable part of the portfolio. An exception to that would be in Emerging Market Debt, where hedging costs are often high, and BlackRock see value in some local currency exposure.

For equities, BlackRock typically hedge 50% of foreign currency exposure to GBP, striking a balance between reducing volatility and preserving diversification. However, this exposure is dynamic driven by three, time varying factors:

- Diversification properties: This considers the correlation between the currency exposure provided by an equity market and the returns of that equity market. The lower the correlation, the more likely the currency exposure will be maintained; the higher the correlation, the more likely it is to be hedged.

- Hedging costs: This takes into account the interest rate differential between GBP and the currency of the equity market holdings. Where positive ‘carry’ opportunities are available, hedging is more likely to be implemented. If the carry is negative, hedging is less likely.

- Market view: This reflects the medium-term outlook for foreign currency performance, based on a combination of qualitative and quantitative factors.

The hedging strategy is implemented through the use of hedged share classes in the underlying funds and ETFs, making access to a broad range of investment products essential for managing currency exposure effectively. A key strength of the service lies in BlackRock’s ability to draw on its full suite of passive funds and ETFs via iShares – one of the largest fund ranges in the market – as well as access to third-party investment managers, combined with its deep investment management expertise.

In summary

Currency plays a bigger role than many realise. BlackRock manage it deliberately – with discipline, flexibility and have the tools and expertise to do it well. It’s all part of building portfolios that are truly designed to deliver.

More information and get in touch

As always, the latest MPS performance data and detailed monthly commentaries are available via our dedicated landing page on Transact. Head to: Transact > Templates > Transact – BlackRock MPS

If you would like to discuss this or any aspect of the service, please contact:

Ben Roberts (Transact MPS Manager)

Mobile: 07717 846574,

Email broberts@integrafin.co.uk,

Book a meeting | Microsoft Bookings

1. Introduction

2. Transact Online (TOL) – Recent enhancements

3. Latest news on integrations

4. Changes to our bereavement process and adviser charging

5. Transact Online & Compulsory MFA

6. Advisers looking to sell and the Transact Succession Planning Service

7. Transact – BlackRock MPS update

8. A study in gifting – what now for assets that qualify for Business and Agricultural Relief?

9. Pension commencement lump sums for individuals with Enhanced or Primary Protection

10. Lifetime ISA – views of the Treasury Select Committee

11. Interest on cash

12. Transact events 2025