TRANSACT – BLACKROCK MPS UPDATE

Capital at risk. The value of investments and the income from them can fall as well as rise and is not guaranteed. Investors may not get back the amount originally invested.

We’re pleased to confirm that all bar one of the models (the Growth 25) has delivered top quartile performance since inception – critically, this has been achieved while consistently maintaining risk within their defined target ranges. See the latest performance for the service against its peer group here.

Transact – BlackRock MPS: Under the bonnet – Diversification

In our ‘Under the Bonnet’ series we take a closer look at the key principles that shape BlackRock’s investment process. Each edition aims to bring greater transparency to the thinking behind the Transact – BlackRock MPS – from the way BlackRock manage risk, to how asset allocation decisions are made. Last month, we explored the approach to currency exposure – a critical but often overlooked element of multi-asset investing. This time, we turn our attention to another core concept: diversification.

Diversification has long been seen as a pillar of sound investing – a way to spread risk and smooth returns. But in a world where market relationships evolve and traditional assumptions are challenged; is it time to rethink what true diversification really means? BlackRock believe achieving it requires more than simply holding a wide range of assets; it demands a research-led, purposeful approach that targets distinct drivers of return. In this article, we unpack how that philosophy translates into the portfolios and why thoughtful diversification remains key to long-term resilience.

Rethinking Diversification

The years following the Global Financial Crisis were characterised by stable growth, falling interest rates, and low inflation. Basic portfolio structures – like the traditional 60/40 blend of equities and bonds – delivered strong, consistent returns. Diversification, in that world, appeared to matter less. But that regime changed decisively in 2020. The onset of the COVID-19 pandemic triggered a global economic shock, exposing vulnerabilities in supply chains, and marked the reawakening of inflation, setting in motion a new and far more volatile market regime.

The sharp sell-off in 2022, where both equities and government bonds suffered double-digit losses, made clear that the old investment playbook had changed. Since then, stock market investments have continued to grow, but at a materially slower pace than in the 2010s, we’ve seen structurally higher interest rates, and growing challenges in the bond market. At the same time, geopolitical fragmentation, increased fiscal strain, and a reversal of globalisation have added to market uncertainty. In this environment, diversification needs to be redefined. It is no longer enough to simply spread capital across a few broad asset classes, within the Transact – BlackRock MPS we believe that true resilience requires deliberate, and granular portfolio construction.

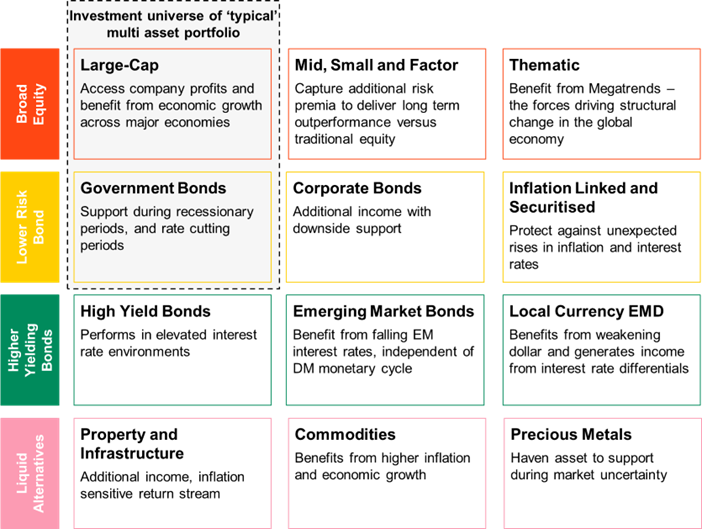

That’s exactly how the Transact – BlackRock MPS portfolios are constructed. The asset allocation spans a wide spectrum of differentiated exposures: developed and emerging market equities, sector-specific and thematic strategies, factor tilts, government bonds, inflation-linked bonds, investment-grade and high-yield credit, emerging market debt, commodities, property, gold and precious metals. And as we discovered last month, currency exposures are hedged strategically. The diagram below illustrates our ‘four pillar investment universe’, each component is included not just for its standalone return potential, but for its role in enhancing the overall efficiency and robustness of the portfolio – giving clients access to a more diverse set of return drivers.

Transact – BlackRock MPS: Four pillar investment universe

Source: BlackRock. For illustrative purposes only.

This approach isn’t simply about risk reduction; it’s about structural advantage. By expanding the opportunity set through uncorrelated and carefully selected exposures, BlackRock aim to push the efficient frontier outward: achieving better potential outcomes for the same level of risk. We believe that in today’s more complex and fragmented market landscape, this kind of diversification is not a luxury – it’s essential. We believe the breadth and intentionality of our MPS provides a meaningful edge for advisers, helping deliver stronger client outcomes in a world where simple solutions no longer suffice.

Dig deeper with BlackRock Portfolio 360

Analyse and compare client portfolios using BlackRock’s free portfolio analysis tool – Portfolio 360.

Diversification is not just about investing across a variety of assets – it’s also about considering how those assets correlate to each other. Portfolio 360 can help uncover these relationships and breakdown how the Transact-BlackRock MPS diversifies.

For example, in Portfolio 360, you can look at the Correlation Matrix table under “Holding Details” to see the correlation factor between individual holdings. A negative correlation (marked in green in the table below) suggests stronger diversification benefits. The tool also provides detailed insights into equity and fixed income characteristics, such as sector, regional exposure and credit quality. Its risk analytics offer particularly useful views into the fixed income sleeve, such as spread and interest rate risk contributions, as well as key rate duration factor exposures – helping you better understand how each component influences overall portfolio risk.

For free access Portfolio 360 head to Transact and go to: Templates > Transact – BlackRock MPS > BlackRock Portfolio 360

More information and get in touch

As always, the latest MPS performance data and detailed monthly commentaries are available via our dedicated landing page on Transact. Head to: Transact > Templates > Transact – BlackRock MPS

If you would like to discuss this or any aspect of the service, please contact:

Ben Roberts (Transact MPS Manager)

Mobile: 07717 846574,

Email broberts@integrafin.co.uk

Book a meeting | Microsoft Bookings

1. Introduction

2. Transact Online (TOL) – Recent enhancements

3. Latest news on integrations

4. Removal of purchase related fees

5. Listen out for the Transact podcast

6. Transact – BlackRock MPS update

7. IHT and pensions – further clarity and procedural changes.

8.Flexibility and ISAs: current rules and planning opportunities.

9. Mansion House and beyond

10. Interest on cash

11. Transact events 2025