Transact BlackRock MPS Two Year Track Record!

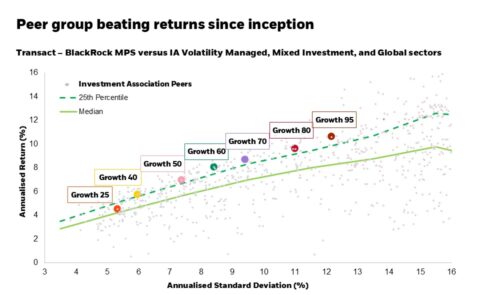

The Transact-Blackrock MPS has reached its two-year anniversary, and we are pleased to report that it has produced top quartile performance against its peer group whilst maintaining the models within their respective volatility targets.

As a reminder we aim to keep costs low for investors – the OCF for each model is capped at 0.20% at the point of rebalance and BlackRock’s investment manager fee is just 0.06%*.

BlackRock have provided us with their latest market commentary below.

A busy week in politics! The impact of the UK Budget and US Election

November was significant for both the UK and US politics with the UK Budget and the US election both taking place within a week of each other. While these events sparked interest, their impact on the MPS was measured, thanks to the broad diversification and asset allocation positioning.

The market reaction to the UK Budget was muted. UK stocks remained steady, and gilts experienced some volatility as investors pushed out their expectations for interest rate cuts. However, with relatively small allocations to UK assets in the portfolios, the overall impact on performance was minimal.

Across the Atlantic, the US election triggered more noticeable market shifts. US equities and the dollar both rose, while Treasuries experienced a modest sell-off. These movements were net positive for portfolios, with gains in US equities and currency exposure more than offsetting minor detractions from the bond market. The asset allocation positioning, including elevated equity exposure and an underweight in US duration further supported returns.

Looking ahead, BlackRock continue to believe that the best hedge against idiosyncratic geopolitical events is to maintain broad portfolio diversification, across an array of asset classes, sectors and regions. The events above have not motivated any immediate change in portfolio positioning; BlackRock remain positive on risk and underweight US duration. In their view the market is now pricing too few interest rate cuts in the UK and too many in the US. Additionally, they expect fiscal policy to be tighter in UK than in US for 2025 and beyond. These factors may prove to benefit UK Gilts over US Treasuries in the medium term.

If you would like to discuss this or any aspect of the service, please contact:

Ben Roberts (Transact MPS Manager)

Mobile: 07717 846574,

Email broberts@integrafin.co.uk,

Book a meeting | Microsoft Bookings

Capital at risk. The value of investments and the income from them can fall as well as rise and is not guaranteed. Investors may not get back the amount originally invested.

*BlackRock Investment Management (UK) Limited pay Integrated Financial Arrangements Ltd 0.02% to cover some of the costs relating to the Transact – BlackRock MPS. This payment is included in BlackRock’s IM Annual Payment fee.

1. Introduction

2. TOL Recent Enhancements

3. Removal of Adviser Purchase Related Fees

4. Platform Health Check

5. Adding Value to family Businesses

6. LoA Discounted Service

7. Transact – BlackRock MPS Two Years On!

8. Pensions Death Benefits and a Time For Reflection

9. Pensions, IHT Headaches And The Potential For Gifting

10. Finance Act 2024 and Abolition of LTA

11. Interest on cash

12. Transact Events 2025