ONSHORE BOND INTERNAL RATES OF TAX

Earlier this month, budget rumours were circulating around a possible increase to the basic rate of tax by 2% with a corresponding reduction to employee class 1 National Insurance Contributions of 2%.

Instead, the standard rates of income tax remain unchanged, but both the dividend and savings rates of tax have been increased (although only the basic and higher rates for dividends), with separate rates of tax proposed for property income.

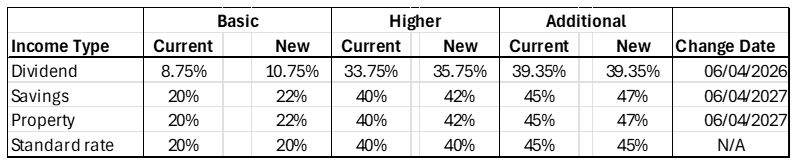

The changes are split over two years, the increase for dividends occurring in April 2026 and the increases for savings and property income the following year. Once implemented, the new rates will look like this:

It is worth noting that chargeable gains from investment bonds are treated as savings income for the individual policyholder. This means that currently a basic rate taxpayer has a 20% tax liability on the chargeable gain, which will usually be covered by the non-reclaimable basic rate ‘tax credit’ associated with the gain. However, as can be seen in the table above, a basic rate tax-payers liability on the gain will increase from 20% to 22% with effect from April 2027. What does this mean for the rates of tax deducted by the life company and the ‘tax-credit’ associated with the gain?

Currently the life company’s rate of tax on policyholder assets is aligned with the standard basic rate of tax and currently there are no proposals to change the standard rates. So, if there are no other changes, life companies would be deducting tax at a rate of 20% on policyholder funds and issuing a tax credit on the chargeable event certificate for 20%. In this scenario, the tax credit would not be sufficient to cover the basic rate tax liability on the gain, leaving a basic rate taxpayer with additional liabilities and reporting requirements.

However, we understand that it is HMRC’s intention to harmonise the rates of tax that life companies pay policyholder funds, so that they match the savings rate of tax. If this is implemented, life companies would pay 22%, rather than 20%, on non-dividend income and gains and allow for an increase to the ‘tax-credit’ of 22%, matching the basic rate taxpayer’s liability and avoiding any additional tax reporting.

Ideally, the alignment would take effect in April 2027, as this coincides with when the savings rate of tax diverges from the standard rates of income tax. However, implementing this change would likely require a change to the primary legislation and a formal consultation period. Moreover, it also requires life companies to update their IT systems to incorporate the new rates. Some companies may struggle with making these changes before April 2027, so a later date may be proposed. No doubt more details on these proposals will be issued in due course.

These proposed and potential changes raise important questions about wrapper selection. A change in the internal tax rates of an onshore bond would create an additional drag on performance. Currently, the internal rates are applied to investment gains and non-dividend income at 20%, with no tax deduction on dividend income. If the rates are harmonised and increased to 22% (in line with the proposed savings income rate), this would represent a 10% increase in the tax deducted within the bond (although dividends would still accumulate free of income tax). By contrast, there is typically no income tax deducted from investment income in an offshore bond, which continues to benefit from gross roll-up. However, investors in an offshore bond will ultimately pay tax on any chargeable event gains, and for a basic rate taxpayer, the new savings rate of 22% would still apply.

Compared to the tax position of a general investment account (GIA), the tax treatment of income received in the onshore bond continues to look more favourable, although the more favourable rates of tax on capital gains tax in the GIA could more than compensate for this. Of course, a key reason for using investment bonds is the ability to defer tax until a chargeable event arises. These events can be timed to points when the policyholder’s income reduces, or through assignment to individuals who pay lower rates of tax than the policyholder. This provides an opportunity to defer higher or additional rates of tax during the accumulation phase whilst realising gains at lower rates of tax. This opportunity will still usually be beneficial for a client, even after taking into account the proposed tax increases.

All information is based on our understanding and interpretation of applicable law and regulation which is subject to change.