The Latest in New Transact Online Functionality – A Digital Transformation

The COVID-19 pandemic striking in early 2020 has provided a catalyst for change in the industry. As we were all driven to remote working for an unknown amount of time, there became a greater reliance on online tools and a need for digital transformation.

It seemed one of the main targets to tackle was reducing the reliance on paper forms and wet signatures on the platform. By providing more digital, time-saving tools, onboarding clients and managing client portfolios has become much faster and more convenient. In this relatively short period of time, Transact has been able to digitally support over 90% of application submissions. By facilitating digital signatures, Upload Documents and Guided Applications, advisers have the ability to self-serve, aiding efficiency and making your life easier.

There continues to be more enhancements being made, recently including account activation for new portfolios with an email address and mobile phone number. Rather than wait for a password letter, clients can activate their account and reset forgotten passwords. And there is more protection through the use of two-step verification, which is available for you and your clients to activate any time. Once activated you will be asked to enter a one-time code with a short lifespan to enter when logging in to TOL, providing an extra layer of security.

Also, our Guided Applications can now be used after an illustration to build online portfolio applications for new wrappers such as GIAs, pensions and ISAs and can now be used for ISA transfers.

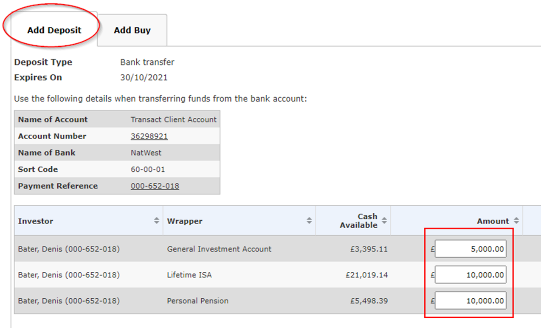

Our latest development is the introduction of the new Expected Deposits functionality. It eliminates the need to follow up, and therefore saves you time by allowing you to notify us of a forthcoming bank transfer and tee up any buys – all at the same time. We then know the deposit is coming, can match your clients transfer to the appropriate wrapper and know and exactly what purchases need to be made. We will place them automatically without any further administration by you.

Some of the benefits of this includes:

- Instructing the buys mean you won’t forget to add them later.

- The deposit is already matched and goes to the right wrapper.

- There is no need to chase for confirmation.

- You can instruct that a LISA Bonus or pension tax relief is invested in the same proportions when they arrive.

To give this a try, log in to TOL and go to: Transactions > Deposit or Transactions > Deposit Then Buy.

All you will need to do is notify us of the forthcoming deposit by adding it to Transact Online, ensuring you add the buys too. Then ask your client to send the deposit to Transact as a bank transfer.

Once the deposit has arrived it will be added as a recently completed deposit on your TOL dashboard. You can also check your client’s Portfolio Valuation to reassure yourself that we have been notified of the forthcoming deposit and potential buys.

For any further guidance on this you can watch the training video here, where there are also other videos that can step you through different areas on TOL.

Feel free to contact your Client Service Team or Sales Support to find out ways you can get the most out of Transact Online.

Want to read more?

Keep an eye on our blog page for future content and insights.

If you are not a Transact user, see what you could expect from our service here, or contact us to find out more.